Answers to Your Life and Health Insurance Questions

VOLUNTARY INSURANCE PLANS

Cafeteria Plans are employer sponsored benefit plans that allow employees the opportunity to receive certain benefits on a pretax basis. Plans must meet the specific requirements of the regulations of the section 125 of the Internal Revenue Code. Thereby ensuring that employees and employers save taxes. The written plan must specifically describe all benefits and establish rules for eligibility and elections.

Qualified benefits include:

- Accident and Cancer

- Medical Flexible Spending Account

- Dependent care assistance

- Dental and Vision

- Medical Health Plans

YES

- Employers save on payroll taxes

- Employees save on income taxes which causes take-home pay to increase

- Increased employee morale

- There is no net cost to implement a section 125 cafeteria plan

NO, all benefits that are offered to employees are decided by and controlled by your employer.

NO, benefits offered to employees are voluntary.

NO, annual elections remain in effect for the entire plan year. Employees can only change their elections once a year during the open enrollment timeframe. Any changes after the start of the plan must be related to a qualifying change in status. Changes may include: change the number of people covered under your plans, enroll in or discontinue your coverage.

Examples of some qualifying events include but are not limited to the following:

- Change in legal marital status

- (marriage, divorce, legal separation, annulment, or death of a spouse)

- Change in the number of dependents

- (birth, death, adoption, placement for adoption, award of legal guardianship)

- Change in employment status for the employee’s spouse or employee’s dependent(s)

- (switching from part-time to full-time employment status or from full-time to part-time, termination or commencement of employment, a strike or lockout, commencement of or return from an unpaid leave of absence which results in employee and/or dependent becoming ineligible for coverage)

- Dependent satisfies or ceases to satisfy eligibility requirement for the plan

Pre-tax dollars are the premiums you pay for qualified benefits under your Section 125 program. These premiums are deducted from your gross (earnings before taxes are taken out allowing your earnings to be taxed on a lesser amount) earnings.

DISABILITY INSURANCE

Disability insurance is designed to pay you a portion of your income (typically 60% - 65%) while you are unable to work due to an injury or sickness to yourself. You are required to be under doctors’ care for the period of time in order for benefits to be paid. A form will be required to be completed by your physician to prove that you are unable to work.

YES, Maternity leave requires an employee to be off of work for a minimum of six (6) weeks or eight (8) weeks for C-section to recover from delivery. Therefore, disability insurance will pay benefits from the time you are under your doctor’s care until you are released from his/her care. This time period must be stated by your physician. Any voluntary time taken will not be covered.

There are multiple policies in the insurance market that defines short term and long term disability. We have seen policies range from 0 days to 2 years of coverage for short term disability. Long term disability is typically coverage from 0 days until the age of 65. A long term policy would be extremely useful if you were to become severely sick and/or injured or even become permanently disabled.

Plans offered by your employer typically will NOT cover your spouse due to the fact that it is based on your income. We have seen policies through employers that enable you to purchase a small rider that could cover spouse however this is rare. Disability insurance can also be purchased on an individual (outside your workplace) basis if your spouse is not offered disability.

YES, however some policies have certain exclusions for this type of accident. Because your employer is required to file Workers Compensation you are not allowed to receive benefits from your disability policy if payment exceeds what you make as an active employee. In other words you are not permitted to make more off the job then you would while working. Be sure to look at your personal policy due to the fact that they all vary on this issue.

In most cases your employer will offer a voluntary benefits package that will include Disability Insurance. There is a specified time frame annually that allows you to enroll in all the voluntary benefits your employer has to offer. Check with your HR representative to see when you are able to review and make changes to your benefits package.

LIFE INSURANCE

There are multiple term life policies that can range anywhere from a 5- 40 year term. Cost will change based on the term of the policy and the age of the insured at the time it is purchased. Most term policies will decrease in face value at the age of 65, so be sure to know how much it will decrease if you plan to keep your policy after that age.

NO, Term life insurance does not accumulate a cash value. Term Life insurance is the most affordable life insurance available, which allows you to purchase more coverage during the years we need more coverage for our family’s needs. Whole and Universal Life are policies that you can purchase that will accumulate a cash value.

CANCER POLICIES

Cancer insurance will protect you from the financial hardship that can affect your family throughout the treatment phases of your sickness. Cancer can often cause a huge lifestyle change (increased travel, eating out more, family member loss of income, out of pocket medical expenses, etc.).

NO, The money received from your cancer policy will be paid directly to you, which will allow you to have control of how those funds will be used. Benefits are not based on your health coverage or any other cover age you may have.

Disability Insurance is designed to pay you a portion of your income while you are unable to work due to an illness or accident while under doctors’ care. This is strictly an income replacement that will help pay the bills associated with everyday living that your payroll would typically cover. Cancer Insurance is designed to help pay unforeseen medical costs along with the additional expenses related to the cancer treatment that are not normally apart of your everyday living expenses. If you were to be diagnosed with having cancer, you and your family will really appreciate having both policies to know that you’ll be financially secure thought the treatment.

ACCIDENT POLICIES

Accident insurance is designed to supplement the gap of what your health insurance will pay versus what you have to pay if you were to have an accident. These benefits are paid directly to you, therefore allowing you to have control of how these funds are used. Accident insurance pays you benefits regardless if it occurs on the job or off the job and is paid based on the injury suffered per your policy guidelines.

BENECOM

FLEXIBLE SPENDING ACCOUNTS

A flexible spending account is a monthly contribution of pre-tax dollars that is offered through payroll. This contribution is designed to help you pay for eligible healthcare expenses, on a tax-free basis, that are not covered or reimbursed under your health plan. Typically expenses that can be paid for through the account are deductibles, co-payments, and uninsured expenses (such as dental care, eyeglasses or hearing exams and medications). These expenses can add up to hundreds of dollars a year.

Any medical, dental, vision and prescription expenses such as charges incurred for the diagnosis, cure and treatment for you or your spouse and eligible dependents to age 26. These changes include co-pays, deductibles, co-insurance, lab fees, chiropractic services, etc. Charges must be incurred during the plan year and while actively participating in the plan. Cosmetic surgery, expenses incurred prior to the plan year or after termination from your employer, prepayment of services, insurance premiums, teeth whitening, and over -the-counter drugs without a written prescription are all ineligible charges. You can log onto our web site, www.myflexoline.com to find a complete listing of eligible charges.

Due to the current Healthcare Reform, all medical reimbursement accounts will have an annual maximum of $2,500.00 beginning 01/01/2013.

The regulations provided by the Internal Revenue Code (Section 125) require that a participant provide a statement with each reimbursement request explaining that the expenses claimed were not paid by insurance or other means and that reimbursement will not be sought by another party.

Once the plan year begins, you may file claims as soon as you incur expenses. Please note that services must be provided before reimbursements will be made.

For most Benecom clients, payments are disbursed each business day.

You can log onto the employee website 24 hours a day / 7 days a week atwww.myflexonline.com. If the claim shows “pending” this will mean the claim is in process.

Do I Have to Provide Proof of Payment With My Claim Form and If So What Documentation Do I Have To Submit?

Each item claimed must be supported by a statement of services from an independent provider. The insurance explanation of benefits (EOB) may also be used since a statement of services has already been submitted to the insurance company for determination of the service date and whether it was a qualifying expense.

Documentation must contain the following information in order for payment to be issued:

- The provider of services;

- The person obtaining care;

- The date(s) of service;

- The amount charged for the services; and

- A general description of the services provided.

No, The IRS does however require that credit card transactions to be reviewed by Benecom Company. Upon reviewing accounts Benecom may send a request by mail for an itemized receipt or an explanation of benefits (EOB), which can be obtained from your healthcare provider. We ask that every time you use your flex credit card you request an itemized receipt at the point of swipe in case documentation is requested.

The IRS requires you to either pay back the ineligible amount or submit eligible receipts that you have not previously submitted for payment to offset the ineligible charge. If you submit a payment for the ineligible charge, it is deposited into your account to use for other eligible charges incurred during the plan year. Should your card be suspended for the ineligible transaction, it will not be reactivated until the issue is resolved. Should you submit claims for reimbursement with a pending ineligible charge, those charges will first be applied to offset the pending ineligible amount prior to receiving reimbursement.

The deadline for filing claims for each plan year is defined in your Plan Document. Generally, plans allow 2 ½ months after the end of the plan year to file claims for services provided during that plan year. Please refer to your Summary Plan Description for specifics on your plan.

Flex plans have a "use it or lose it" rule. If a participant contributes more than he is able to use on eligible charges incurred during the plan year, or 2 ½ month grace period at the end of a plan year, if offered by the employer, any funds left in the account at the end of the plan year are forfeited and returned to the employer.

You have 30 days from the date of termination to claim any unused funds. The date of service must be on or prior to your date of termination.

Complete and sign the Direct Deposit Form. You are welcome to mail the completed form to: Benecom Company, 3429 Stony Spring Circle, Louisville KY 40220 or fax to this form to Benecom at (502) 495-6825.

Benecom provides an employee website that can be accessed 24 hours a day / 7 days a week at www.myflexonline.com.

NO, Annual elections remain in effect for the entire plan year. Changes can only be made to the election amount if a life changing event has occurred. (Change in family status such as marriage, divorce, birth or adoption of a child, death of a spouse or child, or your spouse or dependent child losing or gaining employment.)

DEPENDENT CARE ACCOUNTS

The IRS guidelines allow you to use pre-tax dollars to pay for daycare services provided to your children under age 13, as well as an incapacitated parent or spouse. Per IRS regulations, this can be a licensed day care provider or an individual over the age of 18, as long as they provide a social security number. You are eligible to contribute if you are a single working parent, you are married with a working spouse, and you or your spouse is a full-time student for at least five months during the plan year while the other parent is working or dependent parent is disabled and unable to provide for his or her own care. Benefits provided under a Dependent Care Account are not taxable up to an annual dollar limit of $5,000

A dependent care account has a calendar year maximum of $5,000.00 for a married couple or $2,500.00, for a single parent or if married but filing separate tax returns.

Children under the age of 13, as well as incapacitated children, parent or spouse. Incapacitated would include being disabled or unable to provide for his or her own care.

NO, they do not have to be licensed, unless they care for enough individuals to require licensing in your state. Any person caring for your child must provide you with their Tax ID Number or Social Security Number, as this will be required when filing your Federal income tax returns.

NO, The following childcare providers do not qualify under your dependent care reimbursement account:

- A dependent for whom you (or your spouse if filing jointly) can claim as an exemption,

- Your child who was under age 19 at the end of the year, even if he or she was not your dependent,

- A person who was your spouse any time during the year,

- The parent of your qualifying person if your qualifying person is your child and under age 13.

HEALTH REIMBURSEMENT ACCOUNTS

A Health Reimbursement Arrangement (HRA) is an account provided by and funded by your employer. By setting up this account it allows your employee to enroll its employees in a higher deductible health insurance plan thus reducing the cost of your health insurance premium. Under this plan you will be able to be reimbursed for a portion of your deductible. It works in conjunction with your health insurance.

Benecom can receive claims by fax, email or postal mail.

3429 Stony Spring Circle

Louisville, KY 40220

Email: tracy@benecomco.com

Fax: (502)495-6825

COBRA

“COBRA” stands for the Consolidated Omnibus Budget Reconciliation Act of 1985. It was passed as a result of the economic recession in the early 1980s to temper the increasing rate of uninsured Americans. Many working Americans lost their jobs, initiating the end of employer-sponsored health coverage for those workers and their families.

COBRA gives workers and their families continued health coverage through their previously enrolled health plans when they are discontinued through their employer due to a qualifying event, such as voluntary or involuntary job loss, reduced work hours, transition between jobs, death and divorce. Employers must ensure all employees are aware of COBRA and its limitations. Businesses who fail to comply with all aspects of COBRA can face legal issues and financial penalties. IRS penalties include fines of $100 a day, per beneficiary, for noncompliance.

Every qualified beneficiary, typically an employee, employee’s spouse and dependent children who is covered by a group health plan for a minimum of one (1) day prior to the event causing a loss of coverage. Also, any child born to or adopted by a covered employee during the period of COBRA coverage is also considered a beneficiary.

Virtually all group health plans maintained by employers for their employees are subject to COBRA’s provisions. This includes group health plans of corporation, partnerships, tax-exempt organization and state and local governments. Federal Government, Church plans and small employers employing fewer than 20 employees on a typical business day are excluded from COBRA.

Generally any group health plan that provides health care “maintained by the employer”. Note also that individual policies of health insurance may be considered group health plans subject to COBRA.

Examples of Group Health Plans:

- Dental Plans

- Vision Plans

- Cancer (Disease-Specific) Policies that provide medical benefits (voluntary employee-pay-all-programs that provide only indemnity benefits do not qualify)

- Prescription drug plans

- Health FSA’s

- HRA’s

- Executive Medical Reimbursement Plans

- Drug or Alcohol Treatment Programs

- Wellness Programs

- Employee Discount Programs

- Employee Assistance Plans (EAP) that provides more than referrals

- On-Site Medical Clinics

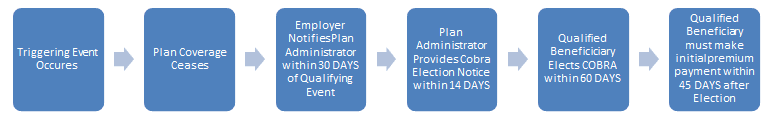

COBRA requires employers to offer a COBRA election to qualified beneficiaries when there is a triggering event that causes (or will cause) a loss of plan coverage within the active coverage period while the plan is subject to COBRA.

Triggering Events:

- Voluntary or involuntary termination of coverage employee’s employer other than by reason of gross misconduct

- Reduction of hours of the covered employee’s employment

- Divorce or legal separation of the covered employee from the employees spouse or Dissolution of a civil union or domestic partnership

- Death of the covered employee

- A dependent child ceases to be a dependent under the generally applicable requirements of the plan

- A covered employee becomes entitled to benefits under Medicare

- An employer’s bankruptcy but only with respect to health coverage for retiree and their family (this triggering even does not appear in the PHSA)

The longest period for which COBRA coverage must be provided is called the maximum coverage period. The maximum coverage period generally is measured from the date of the triggering event regardless of when the election is made.

Basic maximum coverage periods:

- 18 months for termination or reduction of hours

- 29 months for participants eligible for Social Security disability benefits during the first 60 days of COBRA coverage.

- 36 months for death of covered employee, divorce or separation, employee become entitled to medical allowing spouse an extension, child ceasing to be a dependent

A group health plan is not required to provide COBRA continuation coverage free of charge. It may require payment during the period of COBRA coverage up to 102% of the applicable premium. In addition, in the case of disability extension of the maximum coverage period, the plan may increase the charge to 150% of the applicable premium. The premium charged must remain the same for the entire plan year.

A plan may not require payment of the initial premium earlier than 45 days after the qualified beneficiary elects COBRA. After the initial payment is received and paid to the current date, premiums are generally due on the first day of each month, subject to a grace period. The grace period must be at least 30 days.

COBRA is jointly enforced by the Internal Revenue Service, the U.S. Department of Labor and the Department of Health and Human Services.

Penalties for COBRA violations include:

- Excise tax penalties of $100.00 per day ($200.00 if more than one family member is affected)

- Statutory penalties of up to $110.00 per day under the Employee Retirement Income Security Act (ERISA)

- Civil lawsuits

- Attorneys' fees and interest

The most common COBRA administration mistakes are:

- Failing to give a general notice to new employees

- Failing to give the election notice to qualifying beneficiaries

- Failing to offer open enrollment

- Failing to recognize a qualifying event

- Providing coverage when it isn’t required

- Providing more coverage than what is required

- Providing coverage for longer than required

- Failing to terminate coverage when allowable

- Misunderstanding Medicare requirements

- Extending COBRA timeframes incorrectly

- Wording COBRA notices poorly so they are not under Department of Labor regulations

- Failing to document when notices were sent

- Forgetting to collect the COBRA premium

- Overpaying insurance invoices